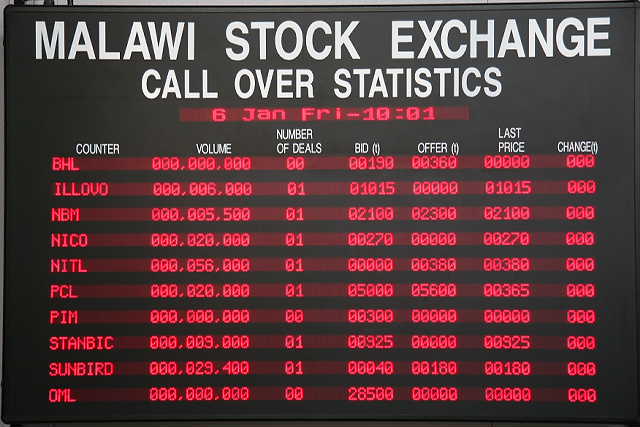

The Reserve Bank of Malawi (RBM) has implemented Automated Trading System (ATS) for Malawi Stock Exchange which is linked to its Central Securities Deposits (CSD), which keeps details of the securities unlike in the past when trading and recording of securities was all manual.

Also present was CAMA Executive Director John Kapito and Boby from National Bank Kabambe mpasises that a cashless society is possible The delegates

This was disclosed by RBM Governor Madalitso Kabambe on Wednesday during a conference at Sun 'n' Sand in Mangochi where RBM gathered digital financial service stakeholders to appraise them on its drive to to accelerate the shift from paper based payments instruments, such as cash and cheques to electronic based services.

Kabambe said the CSD is linked to the world-class national payments system called the Malawi Interbank Transfers and Settlement system (MITASS) to cater for settlement of the securities market.

MITASS is linked all commercial banks through which all transactions; high or low value, are processed in real time and designated time intervals.

"All these systems shall at some stage be linked to regional systems such as SADC-RTGS for SADC and REPSS for COMESA," Kabambe said.

"In a bid to ensure efficiency and effectiveness of the payments systems, the Reserve Bank of Malawi issued the Interoperability Directive in 2017 under the Payment Systems Act of 2016 which ensures that individuals have access to any ATM and point of sale devices through the National Switch (Natswitch) other than be restricted to payment channels provided by their respective banks.

"The regulatory framework is also focusing on consumer protection issues so that users of payment services, be it individuals or business entities, get value for money.

"In addition, the Reserve Bank of Malawi issued the E-money Regulations in June 2019 to among others, provide a regulatory framework for provision of e-money services in the country.

"This Regulation is expected to improve the safety and efficiency of e-money services by providing minimum technical and operational requirements and also minimum standards on customer protection and protection of customer funds which is key for building confidence in digital financial services."

He added that to increase consumer convenience and experience, Government has gazetted the Regulations on Deployment and Usage of Electonic Payment Channels by all licensed businesses in the country.

"Under this Regulation, some sections of the business community will be required to have at least one or more digital payment channels so that customers that are willing to pay electronically should not be inconvenienced.

"As a result of all these tremendous improvements in the payments architecture and the enabling legal and regulatory framework, Malawi has seen the number of bank accounts more than doubling within one year from 1.3 million in January 2018 to 2.6 million as at end of December.

"The number of subscribers on the non-bank mobile money platforms has also increased from 3.6 million in 2016 to 7.0 million as at end of June 2019.

"Likewise, the volume of non-bank mobile money transactions has also risen exponentially from 87.3 billion in 2016 to 122.3 million as at end June 2019 with a corresponding in crease in transaction value from K303.8 billion in 2016 to K710.1 billion as at end June 2019.

"Overall, transactions processed in all digital financial platforms increased by 104.8 percent in volume from 105.4 million in 2016 to 215.9 million in 2018 while the corresponding value increased by 173.5 percent from K1.24 trillion in 2016 to K3.4 trillion in 2018."