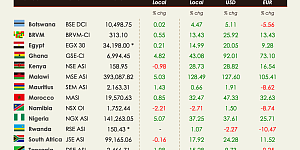

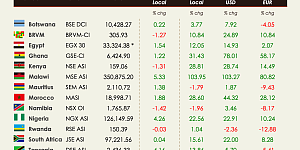

Overall a good performance on African markets with a resilience in South Africa despite political tensions.

The JSE was one of the best performers this week despite the nation’s downgrade as both S&P and Fitch cut the country’s credit assessment to junk. Fitch reduced the foreign-currency and local-currency ratings to BB+, the highest non-investment grade, from BBB- while raising the outlook to stable. Nevertheless, rating on local-currency debt, representing 90% of South Africa’s debt portfolio, will likely remain investment-grade with both Moody’s Investors Service and S&P for the next year. President Zuma, is facing a no-confidence motion in parliament on April 18 supported by opposition parties but as ANC members state they would not vote against Zuma, chances of a step down are thin for now. The JSE gained 1.53%.

Ivory Coast will receive support from the IMF to help finance its 2017 budget to make up for the losses due to coca prices slump. The amount will be decided in June by the IMF board. Cocoa futures have decreased by almost 30% since last July. The country’s budget deficit is expected to increase to 4.5% of GDP in 2017. The BRVM lost 1.62%.

The IMF sees Uganda economic growth accelerating in the coming fiscal year supported by government spending on infrastructure and an expected recovery in lending to the private sector. The fund expects the growth rate to increase to 5.5% in the 12 months through June 2018 as compared to 4.5% this year. The government is increasing its expenditures by 11% and the country is investing in electricity production, roads, railways and an oil pipeline. Tullow Oil, China National Offshore Oil Corp. and Total are developing crude finds estimated at 6.5 bn barrels. The USE lost 0.21%.

Tanzania’s energy regulator increased maximum retail prices of petrol and diesel on Monday because of higher international costs for both crude and refined products and a weaker local currency. This move is expected to put upward pressure on inflation. The DSE lost 0.77%.

The NGSE gained 0.90%. FBN Quest’s Manufacturing Purchasing Managers’ Index for Nigeria recovered to 54.5 in March from 50 in February and the trend was seen across all company sizes.