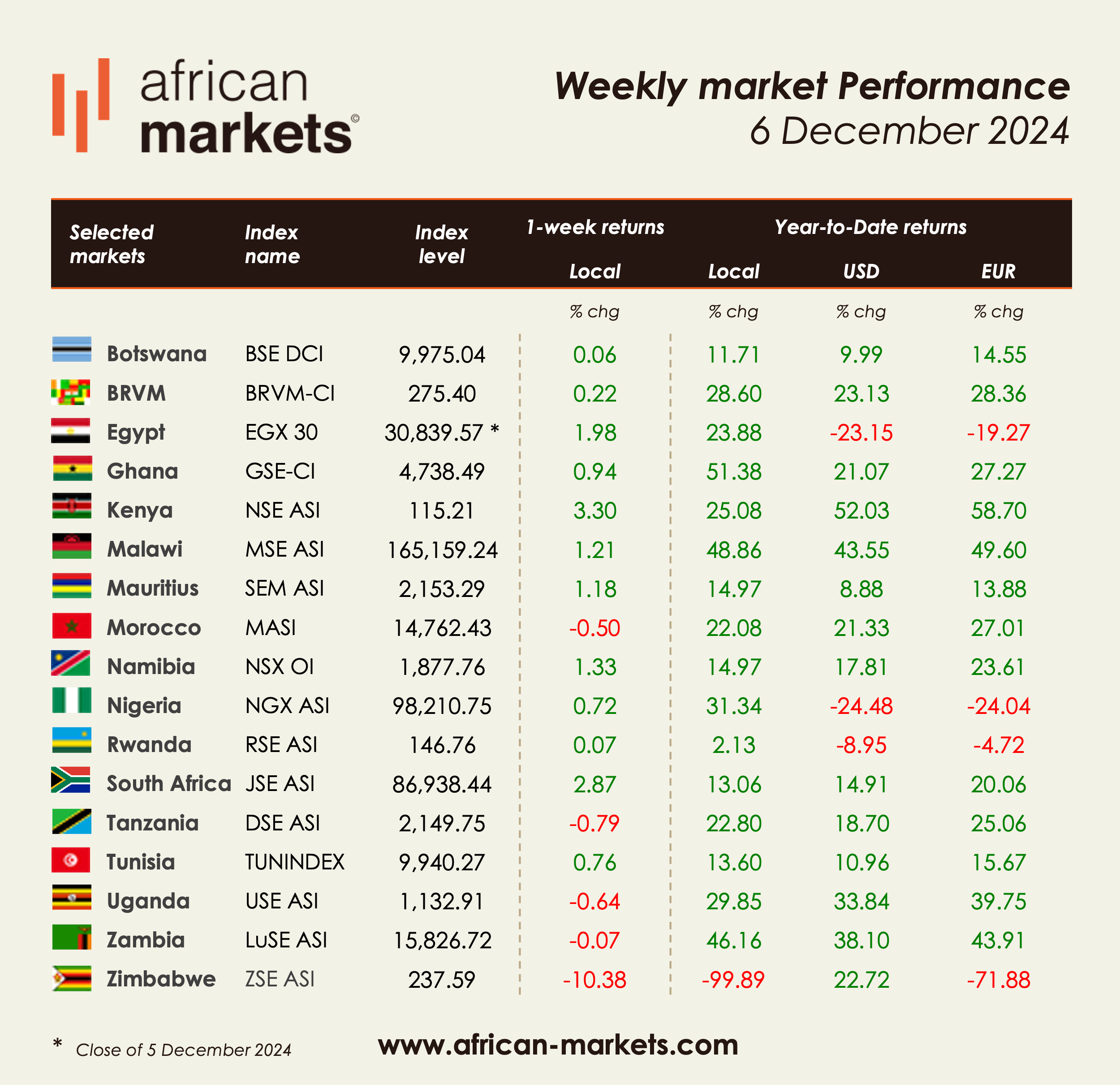

This week brought mixed results across African equity markets, with notable winners and significant declines. While Kenya's stock market continues to surge, reflecting strong investor confidence, Zimbabwe faced sharp setbacks, highlighting ongoing economic instability. South Africa also showed remarkable resilience, adding to its steady year-to-date gains. Let’s dive deeper into the week's standout performances and challenges.

Kenya emerged as the top performer this week, with an impressive weekly gain of 3.30%. This surge reflects renewed investor confidence, aligning with its outstanding year-to-date (YTD) performance. The Kenyan market has delivered YTD returns of +52.03% in USD and +58.70% in EUR, demonstrating both market strength and currency stability.

South Africa also showed robust momentum this week, rising by 2.87%. This gain highlights favorable economic conditions and increased investor confidence in the domestic market.

Egypt, despite facing macroeconomic challenges and significant currency devaluation, recorded a 1.98% weekly increase. However, its YTD returns in USD remain negative at -23.15%, underscoring the ongoing pressures tied to currency instability. On the corporate front, Egypt is set to unveil an IPO plan this week for up to four companies affiliated with the Armed Forces, marking a significant step in its privatization agenda. Additionally, the government has announced plans to launch IPOs for two port handling companies, Port Said Container and Cargo Handling Company (PSCCHC) and Damietta Container and Cargo Handling Company (DCHC), during the first quarter of 2025. These initiatives aim to boost market liquidity and attract foreign investment to the Egyptian Exchange (EGX), despite the economic headwinds.

Malawi maintained its positive trajectory with a 1.21% weekly rise. The market has shown remarkable resilience, with a YTD local return of +48.86%, attracting attention despite its smaller size.

Mauritius delivered a solid performance this week, with its SEM ASI index rising by 1.18%. This gain reflects stable investor sentiment, supported by YTD returns of +14.97% in local terms. Adding to the momentum, the Stock Exchange of Mauritius recently launched SEMX, a new segment designed for high-growth companies. To qualify for SEMX listing, companies must demonstrate a minimum revenue growth rate of 25% on a compound annual growth basis over the preceding three financial years or a 100% growth rate over the past five years. On 3 December 2024, three pioneering companies debuted on this platform: Africa Eats Ltd, Elite Meat Processors Limited, and Ziweto Holdings Limited. This initiative underscores Mauritius’s role as a regional financial hub, fostering innovation and supporting fast-growing businesses.

Nigeria saw its NGX ASI rise by 0.72% this week, reflecting modest market gains. Despite a strong local YTD performance of +31.34%, Nigeria’s returns in USD and EUR remain deeply negative, at -24.48% and -24.04% respectively. These figures underscore the heavy toll of currency depreciation, which has overshadowed the underlying strength of the market. On the corporate front, Holcim announced its exit from Nigeria with the sale of a major stake in Lafarge Africa to Huaxin Cement for $1 billion. This transaction highlights the ongoing shifts in Nigeria’s industrial landscape, as foreign players reassess their positions amid challenging economic conditions.

The BRVM (West Africa) posted a stable weekly gain of 0.22%, bringing its YTD local return to an impressive +28.60%. The market continues to attract investors thanks to strong economic growth in the region and its role as a key platform for francophone West Africa. Notably, the BRVM is gearing up for a major event with the listing of Loterie Nationale du Bénin, set for 13 December 2024. This marks an important milestone for the market, reflecting its growing dynamism and ability to attract high-profile issuers.

Zimbabwe, on the other hand, experienced a dramatic downturn, with its index plunging by 10.38% over the week. This sharp decline reflects the country’s persistent economic challenges, including severe instability and hyperinflation. While the YTD return in USD is positive at +22.72%, this improvement is largely attributed to currency effects, masking the devastating local losses of -99.89%. Adding to the market's woes, National Foods Holdings will be the first company to delist from the Victoria Falls Stock Exchange (VFEX), raising concerns about the exchange's ability to retain and attract listings amid Zimbabwe's economic turbulence.