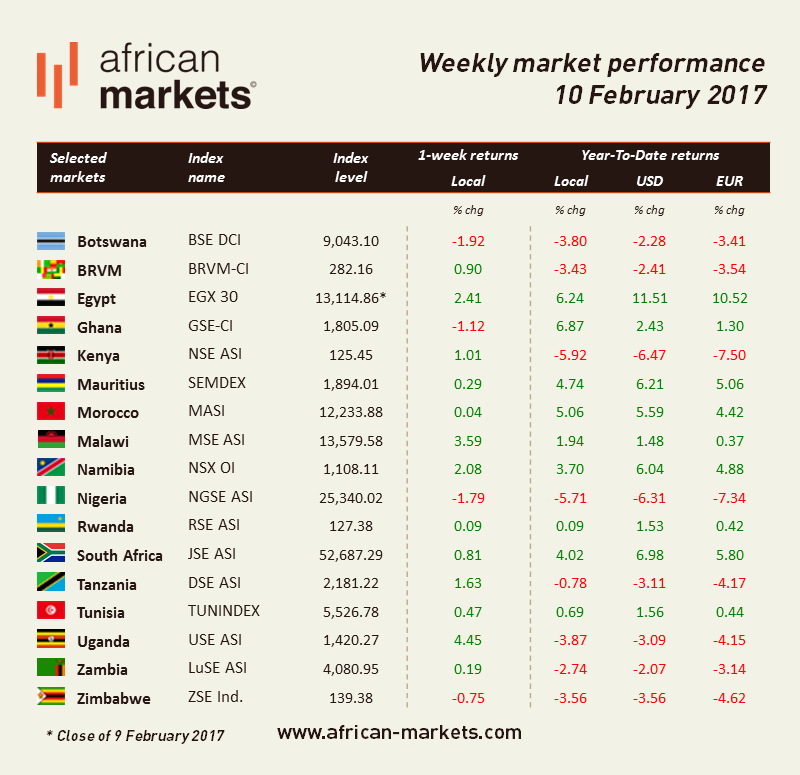

It was a good week for African markets as most indexes ended the week on a positive note! The USE ASI is this week’s best performer, climbing 4.45% while the worst performer is the BSE DCI which lost 1.92%.

In South Africa, this week was the week of the State of the Nation Address which saw President Zuma not providing material change to economic policy. There were few concrete proposals with regards to highly needed economic reforms. However positive surprise came from China's economic data. January exports rose 7.9% from a year earlier, while imports jumped 16.7%, which was ahead of consensus expectations. China is the leading consumer of commodities and, as such, any signs of economic improvement bodes well for commodity-exporting countries like South Africa. Rising commodity prices boosted the JSE ASI higher. The index was up 0.81%.

According to an IMF official, the Tunisian economy should rebound in 2017 and grow by 2.5% from 1.3% before despite challenges ahead. The IMF highlights the public debt which has been increasing and a budgetary deficit which needs to contract. The TUNINDEX gained 0.41%.

The ZSE Ind. lost 0.75%. Zimbabwe is under a liquidity squeeze which is preventing companies from paying their employees and foreign suppliers in cash. The shortage in cash is driving companies out of business while the strong dollar is making imports even more expensive for local businesses. Because companies cannot access inputs due to the lack of foreign currency, productivity in the country decreases which disheartens foreign investment. The IMF expects the economy to contract 2.5% this year.

Nigeria went back to international market and issued $1bn of 15-year Eurobonds yielding 7.875% just below the 8.5% which was originally guided. Nigeria is fighting to escape a recession which hit the country last year following falling oil revenues and a shortage in foreign exchanges. Jaiz Bank Plc, Nigeria’s first Non-Interest Bank is now a public quoted company further to the listing by introduction of its 29,464,249,300 ordinary shares of 50kobo each at N1.25 on The Nigerian Stock Exchange’s Daily Official List on Thursday, February 9, 2017. The NGSE ASI lost 1.79%.

The NSE ASI gained 1.01%. In an interview, Kenyan Treasury Secretary stated that the Central Bank may raise interest rates to protect the currency against volatility. The bank said it may intervene in the market as it deems it necessary as it has enough reserves to stabilise the economy.