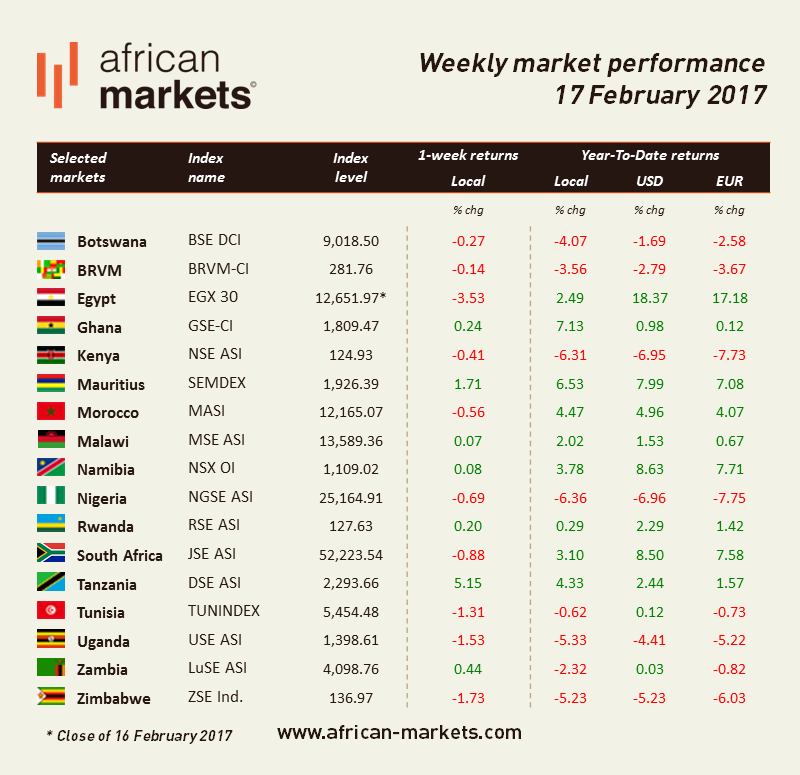

The EGX30 is this week’s worst performer and declined by 3.53% following strong selling pressure after weeks of good performance. EGX heavyweight Commercial International Bank lost 4.39% this week. In other news, the Central Bank of Egypt will issue treasury bills worth EGP 11.5 billion to support the country's budget deficit. The treasury bills will be issued through two tranches, 91-day bills at EGP 6 billion and 273-day bills worth EGP 5.5 billion. The total budget deficit for the fiscal year 2016-2017 is forecasted at EGP 319.46 billion.

In South Africa, baking stocks witnessed their biggest decline in a week as the outcome of a probe investigating banks found a dozen of them guilty of colluding and manipulating trades in the rand since at least 2007. Bank of America Merrill Lynch, HSBC, BNP Paribas, Credit Suisse, JPMorgan Chase and Nomura Holdings have been identified by the Competition Commission as among those that took part in price fixing activities. The investigation is mainly related to rand-dollar trade in offshore markets. The Competition Commission stated that the banks cooperated to reach the desired rand prices by coordinating trading times and created fictitious bids and offers. The Commission recommended that the banks be fined the maximum amount i.e. 10% of their turnover. The JSE ASI lost 0.88%.

According to Nigerian Budget Ministry, the country intends to generate $16.4bn in the next four years through asset disposals. The decline in oil price and output have harmed Nigeria which economy contracted 1.5% in 2016. The government targets 2.5 mn barrels a day by 2020 to boost revenue. The NGSE ASI lost 0.69%.

Ghana's overall fiscal deficit, on a cash basis, in 2016 deteriorated to an estimated 9 percent of GDP, instead of declining to 5¼ percent of GDP as envisaged under the IMF-supported program. This is mainly due to poor oil and non-oil revenue performance and large expenditure overruns. The new President has been vocal about his willingness to implement bold policies to restore fiscal discipline and debt sustainability and also to support growth and private sector development. The GSE-CI gained 0.24%.

In Rwanda, the government announced the sale of its stake of 19.81% in I&M Bank to the public through an Initial Public Offering and subsequent listing on the Rwanda Stock Exchange. All the proceeds of the sale will accrue to the Government of Rwanda. The sale is in line with the government’s divesture programme of state-owned enterprises, which it started in 1997 with a total of 72 institutions earmarked for privatization. The RSE ASI gained 0.20%.