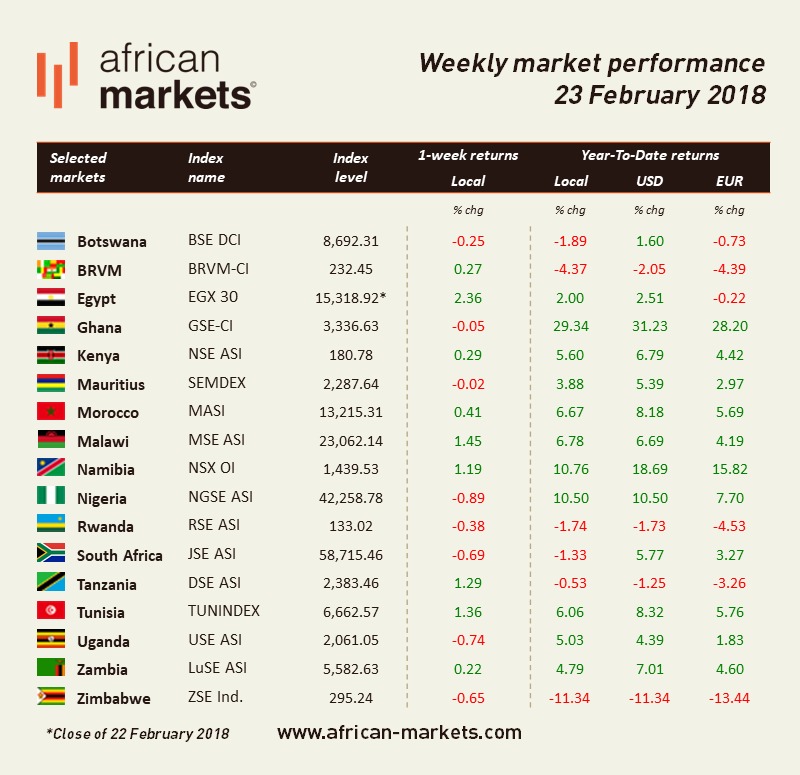

Overall a good week on African markets with the majority of the markets showing strong performance. Namibia is the top performer. The NSX gained 7.35%. As a major trade partner of South Africa and since the Namibian dollar is pegged one-to-one to the South African rand which witnessed a rally, this does not come as a surprise. Sentiment was definitely on the positive side in Southern Africa.

Without surprise, Jacob Zuma resigned this week giving room for newly sworn-in President Cyril Ramaphosa to address his first state-of the-nation to parliament. In his address, Ramaphosa pledged to reinforce South Africa’s economy and rebuild investor’s confidence. Priorities are to reduce the fiscal gap, control debt level and restore state-owned companies. Ramaphosa will be President for a year before the national election takes place in 2019. The task is heavy, and it seems generally accepted that Ramaphosa is highly capable of the task. One major short-term catalyst is the presentation of the national budget to the Parliament next week. The JSE soared 5.76%.

The CBE cut interest rates by 100 bips this week. This marks the first cut since the floatation of the Egyptian pound was put in place in 2016. Both the overnight deposit rate and overnight lending rate were cut by 100 basis points to reach 17.75% and 18.75% respectively. This does not totally come as a surprise since key metrics were pointing to an easing of inflation. Inflation reached 17.1% in January, decreasing for six consecutive months. The EGX30 added 0.30%.

Eurobonds are back as a relatively cheaper alternative of financing for African countries. Following Egypt, Nigeria issued $2.5 bn of Eurobonds this week. The idea is to lower the burden of the more expensive domestic debt, for which the burden nears double-digit yields on local-currency bonds, by tapping into foreign debt. It is said that other countries such as Angola, Ghana, Ivory Coast and Kenya are considering Eurobonds. The Nigerian NBS release January economic data and inflation continues to slow down. CPI dropped to about 15.13% in January 2018, from 18.72% in January 2017. The NGSE lost 1.13%.

Kenyan Finance Minister expects the economy to grow 5.8% this year, recovering from drought and political uncertainty that impacted growth in 2017. The budget deficit is projected to decrease to 6% of GDP in the next financial year starting July, and to 3% by 2022, from 8.9% in the financial year to end of last June. The NSE gained 0.16%.