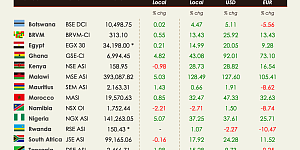

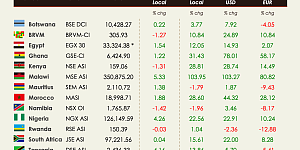

Most of the African markets under coverage closed the week on negative territories. This week is marked by several encouraging economic data notably in Ghana and Kenya.

As widely anticipated, Ghana tapped into international debt markets this week. The country issued $2 bn worth of dual-tranche Eurobonds with 10- and 30-year maturities on Thursday. Ghana issued $1 bn for each of the 10-year notes maturing in 2029 and a 30-year with 2049 maturity at 7.625% and 8.625%. The proceeds are expected to be used for the refinancing of the debt and up to $750 million as revenue for the country’s 2018 budget. The bond issuance follows similar trends we have witnessed in peers such as Angola, Kenya and Nigeria. In the meantime, data showed that inflation slowed to 9.6% which is the first time it reaches the central bank’s target range of 6-10% in a long time. The GSE decreased by 0.63%.

According to Egypt’s central bank, the country’s core inflation slightly increased to 11.62% year-on-year in April from 11.59% in March. Since Egypt devalued its currency in November 2016, inflation has been on the rise. It reached a record high in July on the back of energy subsidy cuts but has gradually eased since then. The EGX30 lost 3.80%.

Zambian finance ministry expects the economy to sustain growth of more than 4% this year helped by its mining, agriculture and construction sectors. While IMF has warned about the likelihood of Zambia to default on its foreign debt, the ministry of finance stated on Tuesday that Zambia had never defaulted on its foreign debt and eurobond interest payments and did not intend to do so. The LuSE lost 0.24%.

Kenya’s treasury expects the budget deficit to drop to 5.7% of GDP in the 2018/19 fiscal year from 7.2% this fiscal year. The deficit peaked at 9.1% of GDP in 2016/17. The NSE lost 1.46%.

The Statistics bureau reported that Rwanda’s year-on-year inflation rose to 1.7% in April from 0.9% in March, the statistics. The RSE declined by 0.17%.