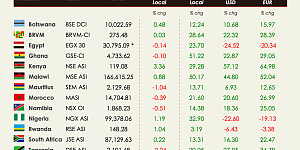

The sentiment was relatively bearish on African equity markets this week. Among the 17 markets we cover, ten retreated while seven advanced. The Lusaka Stock Exchange led the pack as Zambian equities gained 3.35%. Conversely, the Nairobi Securities Exchange was the laggard. Kenyan equities dropped 4.13% this week, the most on the continent.

West Africa

BRVM - Equities in Abidjan rallied this week. Overall, the Composite Index gained 0.61% WoW to close at 176.48. Market activity dropped 27% as XOF 274m (USD 0.50m) worth of shares changed hands every day on average compared to XOF 374m the week before. The market is now up 21.40% year-to-date, and the total market capitalisation amounts to XOF 5,311bn (USD 9.61bn). Bolloré Transport & Logistics is among the top performers this week. Shares in the transport and logistics company soared 19.45% and are up 180% YTD. The market heavyweight, Sonatel, closed lower at XOF 13,700 on Friday (-0.69% WoW) and is now up 1.48% YTD.

NGX - Equities in Lagos cooled down this week. The NGX ASI, the benchmark index of the Nigerian exchange, shed 0.57% WoW, closing on Friday at 39,261.01. Stocks are now down 2.51% YTD. Activity edged up 6% as NGN 1.7bn (USD 4.2m) worth of shares were traded daily on average over the week. The total market capitalisation stands at NGN 20.5tn (USD 49.7bn). Transcorp Hotels is the top performer. Shares jumped 10% and are now up 43.61% YTD. The market heavyweight, Dangote Cement, closed lower at NGN 245 on Friday (-1.84% WoW) and is now up 0.04% YTD.

North Africa

BVC - Moroccan equities retreated as the MASI shed 0.13% WoW. Market activity soared 41% as MAD 104m (USD 11.7m) worth of shares changed hands every day on average compared to MAD 74m the week before. The total market capitalisation stands at MAD 657.8bn (USD 73.8bn), up 13.11% YTD. Douja Promotion Groupe Addoha is among the top performers this week. Shares in the Real Estate company advanced 6.96% and are now up 95.62% YTD. The heavyweight, Maroc Telecom, closed at MAD 141.9 on Friday (up 0.64% WoW). The stock is down 2.14% YTD.

EGX - Bullish sentiment prevailed in Cairo as Egyptian equities closed higher this week. The EGX 30 advanced another 1.58% and closed at 11,301.36 points on Thursday. Compared to the previous week, the average daily turnover declined 17% at around EGP 1.8bn (USD 115.8m), and the total market capitalisation amounts to EGP 745.7bn (USD 47.5bn). The benchmark index is now up 4.21% YTD. Egypt Aluminium is the top performer this week. Shares in the aluminium producer jumped 35.87% WoW and are now up 147.4% YTD. The Egyptian heavyweight, CIB, closed at EGP 47.48 (+0.64% WoW) on Thursday. Shares are now up 6.96% since the start of the year when adjusted for the capital increase. Fawry, the listed fintech company, closed the week at EGP 16.46 (up 1.73% WoW).

East Africa

NSE - Kenyan equities dropped heavily this week. The NSE ASI lost 4.13% WoW to close at 179.47. The average daily turnover declined 16% to KES 397m (USD 3.61m), and the total market capitalisation amounts to KES 2,796.73bn (USD 25.42bn). The market is still up 17.99% YTD. Nairobi Business Ventures is the best performer this week. The shares in the investment vehicle with interests in the raw materials sector jumped 30.30% Wo. It announced its intentions to purchase four companies owned by its new chief executive Haresh Soni and his associates through a share swap. The targeted companies are Air Direct Connect Limited, Aviation Management Solutions Limited, Delta Automobile Limited and Delta Cement Limited. The counter is now up 60.75% YTD. Safaricom closed at 42.15 KES (down 4.96% WoW). Shares are up 23.07% so far this year.

Southern Africa

JSE - South African equities were back in negative territory this week. The JSE ASI declined 1.88% WoW to close at 66,371.88. Steinhoff International Holdings is the top performer this week. Shares in the international retailer soared 44.54% WoW as the company announced on Tuesday that it is considering listing its US-based Mattress Firm to raise money for shareholders. However, multiple options are still being considered, and no decision has been finalised. Recall that Steinhoff, which has vast debts, faces more than 100 legal claims in Europe and South African of about ZAR130bn that it argues could push it into bankruptcy and leave claimants with nothing. The company is holding a meeting on Monday with various creditors to vote on accepting its global settlement offer. The counter is now up 255.77% YTD. The JSE heavyweight, Prosus, closed higher at ZAR 1,247.85 on Friday (+4.94% WoW). Shares in the tech investor are now down 18.47% YTD.

ZSE - Equities in Harare extended losses this week as the ASI declined another 1.15% WoW. Daily average turnover remained flat at around ZWL 88m (USD 1.02m) compared to ZWL 93m the week before. The total market capitalisation amounts to ZWL 793.1bn (USD 9.22bn), up 152.56% so far this year.