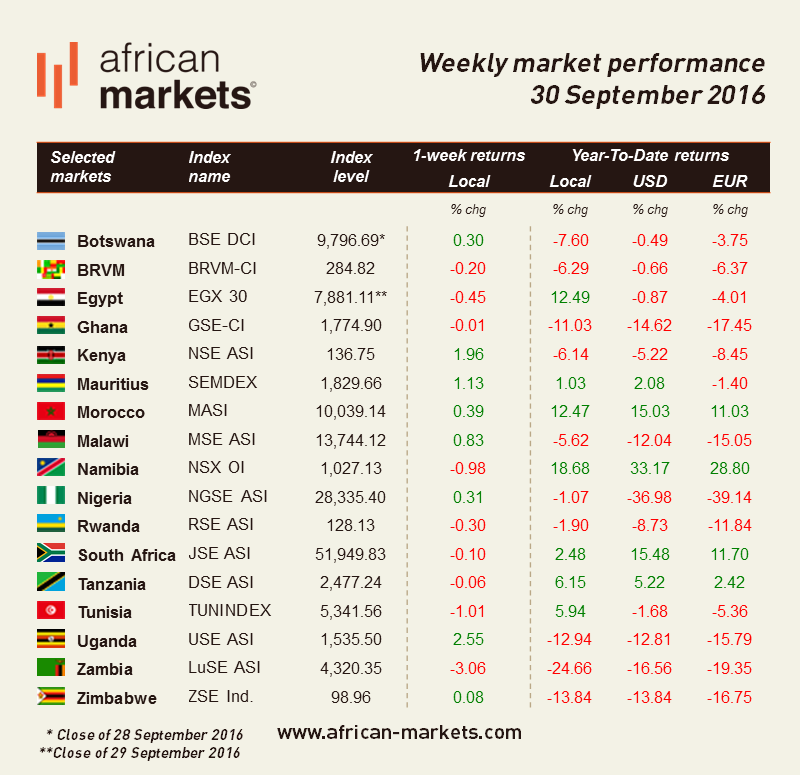

NSE ASI gained 1.96% this week. In an interview, Central Bank Governor Njoroge stated that the Kenyan economy was “resilient and diversified” enough to survive any potential negative effects from elections next August. According to the governor, prospects are “very good”. He sees capital projects as the solution to boost output and the economy’s global competitiveness. This interview came as investors become more and more concerned about a possible slowdown in output because of declining private-sector credit growth and the risk of frenzied elections.

NGSE ASI gained 0.31%. Nigerian banks are struggling as the economic slowdown is hurting their revenue and their ability to raise capital. Nigerian banks face tough challenges, in July, a few of them breached regulations on capital adequacy. A report states that non-performing loans in the industry may increase to 12.1% in 2016 from 4.9% this year mainly because banks’ credit are highly concentrated in the oil and gas industry. As the country is in need of funding to cover its budget deficit, Access Bank Plc, the country’s fourth-largest lender by assets is starting to market the first sale of Eurobonds from Nigeria since 2013. In other news, Nigerian lawmakers are accusing MTN of illegally moving almost $14bn out of its largest market. The banks involved in the alleged illegal transfers are Citigroup, Standard Chartered and Nigerian lenders Stanbic IBTC Holdings and Diamond Bank.

IMF gave its approval to a further release of $116 mn instalment to Ghana which is part of an almost $1bn bailout plan for the country. In 2015 Ghana called for IMF support after lower gold and cocoa prices and oil exports increased its debt and caused its currency to decline versus the dollar. Ghana raised $750mn at a yield of 9.25% earlier this month in an auction that was more than four times oversubscribed. According to the country’s Finance Minister, about $400mn of the proceeds will be used to refinance Ghana’s first 10-year and which matures in 2017 while the remainder will be used for capital projects. GSE-CI ended this week flat with losing 0.01%.

The EGX30 ended September in red after two successive months in green, as the main index EGX30 lost 3.39% or 2.76.93 points month-on-month to close at 7,881.11 as compared to 8,158.04 points in August.

The JSE ASI rallied strongly in line with global markets on Thursday as energy shares pulled markets higher globally in response to an agreement by Organisation of the Petroleum Exporting Countries (Opec) members to curb output to a range of 32.5 to 33.0 million barrels a day from the group’s current estimate of 33.24 million barrels. It still ended this week losing 0.10%.