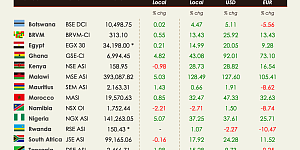

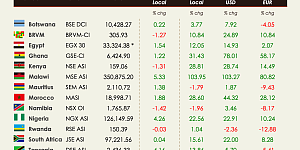

Oil surged above $40 a barrel as US output continue to fall and as we approach the meeting where suppliers will negotiate freezing output in an attempt to stabilise prices. Among major global currencies, the Rand soared the most, helping to limit a weekly slide in emerging-market currencies. Oil price increase supported demand for riskier assets as investors’ concerns over a slower growth was reinforced by IMF’s likely reducing outlook for world growth following the WTO’s decrease in trade growth forecast citing slowing China. As sentiment remains fragile, the lower dollar is helping commodities and African markets. For illustration purposes, according to Institute of International Finance estimates, emerging-market inflows hit a 21-month high at $36.8bn in March. Weaker dollar as well as the dovish Fed, easing downward pressure on local currencies, is postponing the pain for African markets for now. A fragile equilibrium partly owning its stability to foreign monetary policies.

In South Africa, the National Treasury sold a $1.25 bn 10-year bond with a coupon of 4.875%. This deal happened just a few days after a failed attempt by the opposition to impeach the country’s leader following a series of political scandals and in the same week Standard & Poor’s reduced its forecast for South-African growth. JSE ASI fell by 0.31%.

EGX30 saw a sudden decline this week. Is it a normal correction after a wave of uptrends or negative impact from Giulio Regeni’s murder on Cairo bourse or both? Other than that rumours has it Egypt signed 13 loan agreements worth $1.9 bn with Saudi Arabia during Saudi King’s visit this week.

In Kenya, Chase Bank Kenya was put under receivership for a period of 12 months this week. After the Dubai Bank, the Imperial Bank, Chase Bank is the third bank to be taken over by the central bank. This fuelled concerns about the healthiness of the Kenyan banking sector. Another trouble in the banking paradise as Wednesday the National Bank reported a Sh1.15 bn loss which it attributed to bad loans which amounted to Sh3.2 bn towards the end of the year. The National Bank did so without prior warning investors as is required by law for all companies listed on the NSE. This comes as last week the National Bank’s CEO and five senior officials were put on compulsory leave pending an internal audit as loan loss provisions pushed the lender into a loss. NSE ASI decreased by 0.64%. According to a senior Treasury official, the government will agree a $600 million loan from China to help fund a budget deficit in the fiscal year starting last July.

In Nigeria, President Buhari also announced he will sign a loan deal of up to $2 bn with China. NGSE ASI was down 0.70% this week.