Vunani Fund Managers, a boutique asset management company that provides a broad suite of investment solutions for institutional and retail clients, has today listed its first Actively Managed Exchange Traded Fund (AMETF), the Vunani Global Equity Prescient Feeder Actively Managed ETF on the Main Board of the Johannesburg Stock Exchange (JSE).

Trading under the alpha code, VUNGLE, the AMETF aims to provide investors with long term capital growth by investing in global equity and equity-related securities, particularly within developed markets. It is a feeder structure into the Irish-domiciled UCITS fund, the Vunani Global Equity Fund, benchmarked against the MSCI World Net Total Return Index.

“Vunani Fund Managers is excited about increasing the investment tools available to a broad range of investors, thereby deepening and widening financial inclusion in South Africa,” said Vunani Fund Manager’s CEO, Butana Khoza. “This listing paves the way for Vunani Fund Managers to execute on our strategic objectives focused on new distribution channels, to grow our footprint and attract a varied client base, such as retail investors looking for active fund management and the benefits of active trading, live pricing and easier access to liquidity.”

The listing of Vunani’s first AMETF positions the fund manager for growth, differentiation and enhanced investor engagement in a highly competitive market. This ETF provides investors a simple and efficient way to access their global equity capability via the JSE.

“This listing demonstrates our ability to adapt to new investment trends, appealing to different investors and their respective investment solutions. It will enable us to engage with clients throughout their investment journey, providing better insight and a better customer experience,” said Khoza.

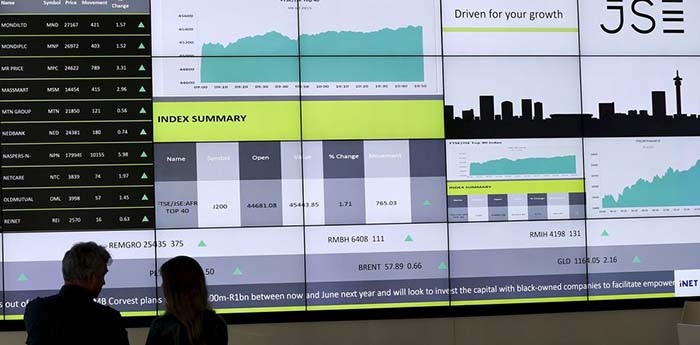

“As the JSE, we are proud to welcome Vunani Fund Managers as they debut their first AMETF on the Main Board. As an exchange, our position is to be a market convener and a conduit for companies and investors alike, as well as to create an enabling environment for our capital markets to thrive,” said Adèle Hattingh, Manager: Business Development and Exchange Traded Products at the JSE.

The listing of the Vunani Global Equity Prescient AMETF increases the number of ETFs listed on the JSE to 111 with a market cap of R184. billion.