After gaining regulatory approval in 2014, and depository approval last year, ALTX East Africa Ltd has today gone live with its new securities and derivatives exchange, regulated by the Capital Markets Authority of Uganda.

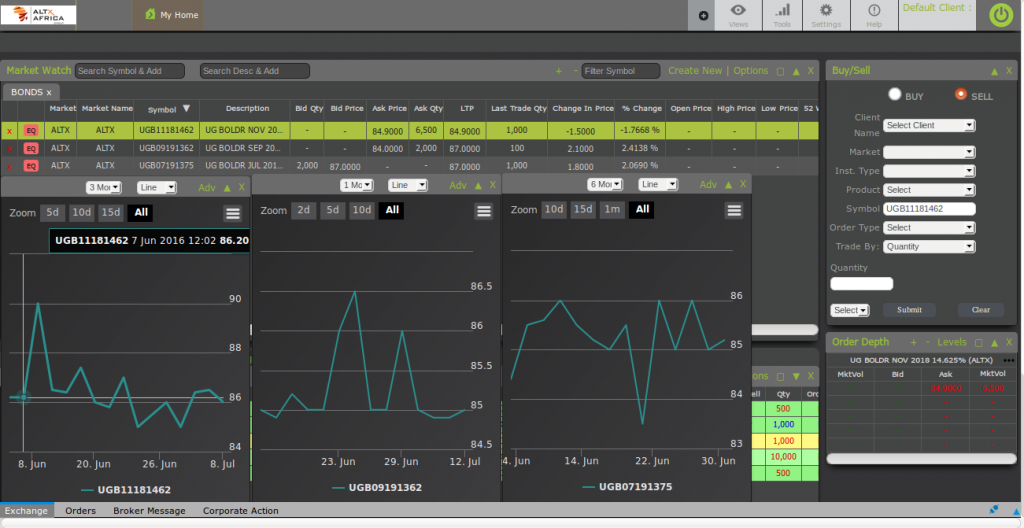

In addition to ALTX East Africa, ALTX Clearing Ltd provides full derivatives clearing capabilities and operates a host of depository solutions including securities custody, registry, lending and borrowing, securities pledging and release, interdepository transactions, and mobile registration and trading for retail clients, powered by its CSD-R technology.

Technology synergy

The new launch included help from partnerships with London-based GMEX Technologies – which provides exchange technology and had taken a stake in ALTX in 2015, and ESCROW Group – a provider of securities management systems.

GMEX Technologies CEO and Director of ALTX Hirander Misra said in a statement: “ALTX demonstrates the outcome of determination, knowledge and clarity of strategy. To GMEX Technologies Ltd, ALTX now represents a working model of exchange establishment done by people who understand the opportunity space in Africa.”

“We are happy that ALTX East Africa has reached this milestone in their journey and as the regulator, we expect ALTX to deliver on the securities products that they indicated to us in their plans and to ultimately grow the investor and issuer base in Uganda, considering that domestic savings which are currently growing at an annual average rate of 30% do not have sufficient investment options,” said Keith Kalyegira, CEO of Uganda’s Capital Markets Authority, commenting in an official statement.

Mr. Kalyegira added: “We are also hopeful that ALTX’s existence will increase the number of skilled capital markets practitioners and intermediaries.”

T+1 Settlement

An official announcement of the launch highlighted that ALTX East Africa can handle 150,000 transactions per second, with trade settlement enhanced via an automated process that will enable clients to access cleared funds on the same day instead of waiting several days for funds to settle from closed trades.

“The technology package that ALTX has assembled for the ALTX East Africa exchange is blazing the trail in terms of performance and risk management”, said Joseph Kitamirike, CEO and co-founder, commenting in a statement regarding the launch.

Mr. Kitamirike added: “We spared no expense to access the best and most reliable technology, seeking to ensure that our customers who will always want to associate with a leader have access to the best.”

CEO’s background

Mr. Kitamirike is a Senior Director at the Albright Stonebridge Group in Washington, DC, and holds a Bachelors degree in Mechanical Engineering from Makerere University, and an MBA in Finance from the University of Connecticut in the US.

He served as a director on the Board of the Central Depository & Settlement Corporation of Kenya for three years, and for Fidelis International Institute, and as executive member of the African Securities Exchange Association (ASEA) until August 2013 when he became chairman.

Mr. Kitamirike also held the role of CEO of Uganda Securities Exchange for a 3-year period until 2013, before becoming CEO of ALTX and after co-founding ALTX Africa Group (AAG) in Mauritius with Jatim Jivram – one of ALTX’s current board members. AAG plans on opening at least 10 exchanges across Africa with connectivity to nearly twice as many international venues.

Getting listed in Uganda

In terms of why companies should consider becoming listed on ALTX, the company noted that it is the first exchange in Uganda and East Africa to introduce a fully automated trading and settlement cycle with same-day trading. It also added in a description on its website that it is the first in the region to offer a multi-asset platform including depository receipts, ETFs, and asset-backed securities, and multi-currency securities trading, as well as cross-border trading memberships.

Finance Magnates recently wrote about the fintech-startup MyBucks becoming listed in Europe and its presence across countries in Africa, as the financial markets landscape appears ripe for further development and across its capital markets – including in Uganda. GMAX had also made headlines earlier this year when it provided technology to an emerging exchange in the U.S., as detailed in a related post.