2017 was a year of revival on African markets. The African economy witnessed early signs of recovery last year. Inflation, current account, demand and other economic fundamentals showed bettering trends in numerous countries. This translated into positive performance of most of the markets under our coverage.

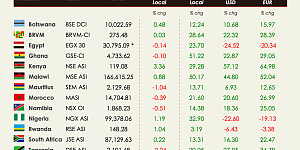

Patience was highly rewarded for investors in Malawi, Ghana, Nigeria, Uganda and Kenya’s stock exchanges which represent the top 5 performers of 2017 if we exclude the exceptional and counter-intuitive performance of Zimbabwe. The MSE added 62.1%. The benchmark benefitted from positive sentiment following improved agricultural production as weather conditions improved, a significantly lower inflation as well as fiscal reforms. We expect MSE’s performance to be mixed this year as 2019 elections start to loom in the horizon and fiscal pressure spending could consequently increase.

While being 2016’s worst performer both the GSE and the NGSE outperformed strongly this year gaining 52.7% and 42.3% respectively. Ghana’s GDP growth rate rebounded to 9.3% in 3Q17 from 3.5% in 3Q16 driven by fiscal and monetary discipline. Much needed reforms have been put in place by the newly elected President and the country has started to reap the fruits. Nigeria has seen its performance accelerating following the floatation of its currency for foreign investors which brought back inflows in the country. The USE gained 32.8% as the country saw a strong economic performance in comparison to other countries in the sub-region.

Finally, the NSE gained 28.39%. The performance was mainly back-end loaded as GDP growth slowed in 2017 following drought, political tension around elections and caps on commercial banks’ lending rates which affected private sector investment.

Two main highlights for 2017 are the well anticipated downgrade of South Africa’s long-term local and foreign currency credit ratings and the exponential performance of the Zimbabwean’s stock exchange driven by a liquidity crisis. The JSE still added 17.47% while the ZSE Ind. added 130.42%.

Our expectations for 2018 are for the recovery to continue. The African Development Bank expects African GDP to grow 4.1% in 2018 from 3.6% in 2017. As always, the devil is in the detail and not all African countries will benefit equally from improving fundamentals.

We are bullish on Ghana. The country should perform strongly on the back of continued reforms, positive developments in non-oil sectors, lower inflation and fiscal discipline. Nigeria should enjoy a positive sentiment following higher oil prices, higher agriculture production and higher foreign currency liquidity thanks to measures taken by the central Bank. We continue to see East-African markets as more inclined to drive sustainable growth and consumers-led sectors as well as infrastructure, power and agriculture to outperform. Kenya’s diverse economy should support its performance this year. After a mixed economic performance in 2017, we see main macroeconomic indicators going back to healthier territories.

South Africa and, to a lesser extent, Zambia could surprise on the upside. All in all, three things need to happen to make us more bullish on South Africa: fiscal adjustments that drive revenues, structural economic reforms and better governance at state-owned companies. Zambia’s fundamentals could see improvement driven by increased demand for copper, energy reforms and fiscal discipline.

Finally, we see persistent pressure in Zimbabwe. Key structural challenges such as a collapse in agricultural production and hyperinflation remain which should continue to cloud the performance of the index.