This month, African markets have been marked by Four East African countries: Rwanda (RSE), Uganda (USE), Tanzania (DSE), and Burundi, who have finally merged their stock markets through a decade-long automation project to attract investment. It is a project that has been in the making since 2011 when countries from the region embarked on integrating their stock exchanges. The technology platform dubbed the EAC Capital Markets Infrastructure (CMI), developed by a Pakistan-based private firm, will basically interconnect all the region’s trading systems: Through the platform, investors in the four countries will be able to buy and sell shares of companies listed in any of the countries without going through different stakeholders.

It is important to note that Kenya (NSE), who currently has the largest and active capital market in the region, had reportedly pulled out of the project in 2015 over alleged procurement irregularities,

In Tanzania, JATU Plc, a Tanzania-based agri-based company, started trading on the Dar es Salaam Stock Exchange (DSE) on Monday November 23. The start-up listed 2,164,349 shares on DSE's alternative market at a price of 420 TZS. The company, which hadn't gone through an IPO, becomes investors’ darling stock after listing as it saw its share rallying to 460 on the first day of listing, and appreciated by 24% in the first trading week.

In Zimbabwe, the Run of de-listings on the Zimbabwe Stock Exchange continues. Powerspeed, one of country’s largest electrical goods dealers, has started the process of de-listing from the local bourse after 22 years. This year, six companies have already exited, or are in the process of exiting, making this one of the toughest years on Harare’s main capital market. Miner Falcon Gold left the ZSE citing low trading. ZimRe Property Investments and SeedCo International also delisted; SeedCo international has since listed on the new Victoria Falls Stock Exchange (VFEX), which offers trading in US dollars. Dawn Properties is also set to delist from the bourse after African Sun Limited made an offer to acquire 100 percent shares.

In Northern Africa, Morocco’s regulator gave the green light to the listing of Aradei Capital on the Casablanca Stock Exchange. The operation will be carried out through a capital increase and a sale of shares. The company will have ARD as its ticker and its introduction is scheduled for December 14th.

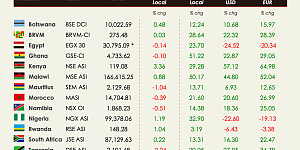

Download the NOVEMBER issue of our "AM MONTHLY MARKET REPORT", a monthly recap of African equity market performance: indices, company shares, market cap., currencies...