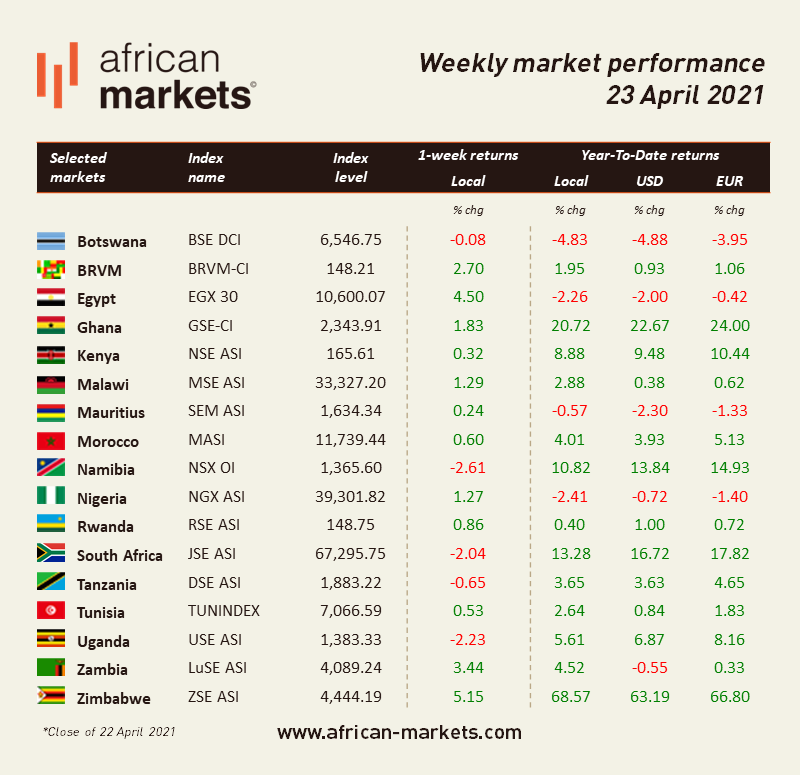

Overall sentiment on African equity markets was positive. Among the markets we cover, 12 of them advanced this week while 5 retreated. Zimbabwe was back at the top of the performance chart as equities in Harare rallied 5.15%. Conversely, Namibia was the laggard. Equities in Windhoek shed 2.61% over the last five days.

West Africa

BRVM - Bullish sentiment prevailed in Abidjan as equities on the Western Africa regional exchange advanced for another week. Overall, the Composite Index gained 2.70% to close at 148.21. Market activity declined by 13% as XOF 633m (USD 1.16m) worth of shares changed hands every day on average. The market is now up 1.95% year-to-date and the total market capitalization stands at XOF 4,460bn (USD 8.2bn). SMB is once again the top performer this week as shares in the producer of road bitumen and by-products jumped another 42.9%. The counter has now more than doubled since the start of the year (+117.37%). The market heavyweight, Sonatel, closed the week at XOF 13,795, up 0.77% over the week. Shares in the telecom operator are now up 2.19% year-to-date.

NGX - Equities in Lagos rallied this week. The benchmark index of the Nigerian exchange gained 1.27% WoW closing on Friday at 39,301.82. Stocks are now down 2.41% YTD. Activity quadrupled this week as NGN 8.4bn (USD 22.12m) worth of shares were traded on average over the last five days driven by significant trades on MTN Nigeria stocks on Monday. The total market capitalization stands at NGN 20.6tn (USD 54.0bn). PZ Cussons Nigeria was among the top performers this week. Shares in the consumer goods company jumped 21.11% and are now back in positive territory since the start of this year (+2.83%). Dangote Cement, on the other hand, remained flat at NGN 220. The shares in the cement producer are down 10.17% YTD.

North Africa

BVC - Morrocan equities advanced for another week. The MASI gained 0.60% in a week that saw MAD 100m (USD 11.3m) worth of shares change hands every day on average. The total market capitalization stands at MAD 607bn (USD 68.2bn), up 4.01% YTD. Cosumar is one of the top performers of the week. The shares in the sugar producer rose by 4.08%. The counter is now up 21.37% YTD. The heavyweight, Maroc Telecom, closed at MAD 136.95 on Friday. The stock is down 5.55% YTD.

EGX - After seven weeks of decline, Egyptian equities rallied this week. The EGX 30 soar 4.50% and closed at 10,600.07 points on Thursday. Compared to the previous week, average daily turnover dropped 15% to EGP 0.82bn (USD 52.3m) and the total market capitalization amounts to EGP 654.4bn (USD 41.7bn). The benchmark index is now down 2.26% YTD. The Egyptian heavyweight, CIB, closed at EGP 58.46 on Thursday, down 1.23% YTD. Note that Fawry, the listed fintech company, closed on Thursday at EGP 20.77, following the approval of the listing of its rights issue at EGP 20.29.

East Africa

NSE - Kenyan equities advanced for another week. The Nairobi Securities Exchange’s benchmark index edged up 0.32% WoW. The average daily turnover increased by 2.8% to KES 482m (USD 4.5m) and the total market capitalization amounts to KES 2,544bn (USD 23.45bn). The market is now up 8.88% YTD. Bamburi Cement is among the top performers this week. The shares in the cement producer jumped 6.01% WoW as the company announced a 144% increase in pretax profit for 2020. The counter is now up 7.27% YTD. Safaricom advanced this week as shares in the telecom operator closed at KES 38.80 on Friday, up 1.04% WoW. The counter is up 13.28% so far this year.

RSE - MTN Rwandacell Plc (MTN Rwanda) has announced that it will list on the Rwanda Stock Exchange (RSE) on May 4, 2021, following the approval by the Capital Market Authority (CMA) and the Rwanda Stock Exchange (RSE) of MTN Rwanda’s listing by introduction on the RSE and the approval of Crystal Telecom’s (CTL) shareholders to distribute 20% of MTN Rwanda’s shareholding held by CTL to CTL shareholders effective from the listing date.

Southern Africa

JSE - South African lost steam as the JSE ASI dropped 2.04% to close at 67,295.75. The overall lackluster performance of the JSE was in step with other global markets, which have been battling lately to find momentum after hitting record highs in the first quarter. The South African benchmark index is now up 13.28% YTD. The JSE heavyweight, Prosus, closed at ZAR 1,597.26 on Friday (-2.71% WoW). Shares in the tech investor are now down 0.55% YTD. Karooooo, a software company, listed on the JSE’s Main Board on April21. Karooooo is the controlling shareholder of Cartrack, the previously JSE-listed fleet management and vehicle recovery specialists. The week was also marked by The Coca-Cola Company and Coca-Cola Beverages Africa (CCBA) which announced plans to list CCBA as a publicly traded company within the next 18 months, Shares will be listed in Amsterdam and Johannesburg, with Amsterdam being the primary exchange.

ZSE - Bulls were back in Harare. The ASI rallied 5.15% this week, making the ZSE the best performing market on the continent. Daily average turnover increased to around ZWL 203m (USD 2.40m) from ZWL 136m the week before. The total market capitalization amounts to ZWL 517.6bn (USD 6.13bn), up 68.57% so far this year.