To hike or not to hike that is the question... This week was all about what is happening in western central banks. The unexpected turn to a more pro-hike view from a normally dovish Fed governor weighed on markets in Europe, where sentiment was already blue following the choice of the European Central Bank against expanding its stimulus program. The market seems to view this as a turning point for African markets, by tempering excitement for additional stimulus, the ECB’s decision raised questions about how much further the emerging-market rally can run as stocks trade near 14-month highs and bond yields remain close to the lowest levels since 2013. As often is the case, the picture for African markets is mixed in both cases and until there is more clarity about when exactly the US interest rates will be increased, some volatility is to be expected creating opportunities for the risk -seekers.

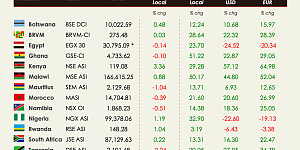

The JSE traded lower in the middle of the week, as the local market failed to benefit from the emerging-markets rally. Although the rand traded almost 2.5% higher at R14.02 per dollar as data showed South African economy grew more than expected in the second quarter, major stocks on the JSE were mostly lower as a strong local unit is detrimental to big rand hedge shares, which represent most of the bourse’s market capitalization. The country's GDP grew 3.3% in the second quarter while consensus was for a 2.6% growth enabling South Africa to avoid a recession after a 1.2% contraction in the previous three months. On top of that, the country recorded a trade surplus of 33.3 bn rand thanks to the value of exports growing faster than imports. The rand lost its gains on Friday as global concerns following North Korea's nuclear test compounded domestic political uncertainty, sending investors fleeing to safe haven assets. By the end of the week, the JSE recuperated some breath thanks to companies with sales outside South Africa which stand to benefit from the weaker currency. The JSE ASI lost 0.30%.

The EGX30 showed a positive performance during this week ahead of Eid al-Adha vacation which will last from 11-13 September. The index gained 51.76 points to reach 8188.2 points supported by the strong performance of its heaviest constituent, the Commercial International Bank (CIB). The latter increased by 2.5% a week earlier. EGX gained 0.64%.

The NSE ASI remained weak loosing 1.92%. Weaknesses continue as one approaches enforcement date of the Kenyan rate-cap law, the new law which imposes limits on the amounts commercial banks can charge their customers for loans. However, uncertainties remain as to whether banks should use the Central Bank Rate or the lower Kenya Banks Reference Rate as the law as it is today seem unclear to many. Critics to the law complain about the lack of clarity but also the potential damage it could cause to the economy. The law is supposed to enter into force on the 14th September.