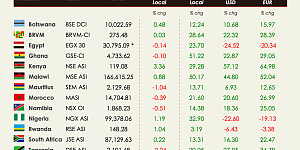

Going into the second week of December, African markets showed mixed performances. BRVM declined 2.18% to close the week at 298.40. The same declining trends was witnessed on the EGX30 (-2.09%), GSE-CI (-0.94%), MASI (-2.35%), NSX-OI (-13.63%), NGSE ASI (-1.31%) and the JSE ASI (-2.47%).

Indeed, the EGX30 was among other things pulled down by the 3.5% loss posted by heavyweight, CIB on Tuesday. MASI moves notably translated the 10% decline of the IB MAROC and the 9.63% decline of SONASID. As far as the NSX OI is concerned, PSG Life Limited received revised income tax assessments from the South African Revenue Service which includes an alleged normal tax payment shortfall of R113 million plus interest of R86 million and understatement penalties of R169 million. Moreover, Anglo American PLC announced its willingness to “set out an accelerated and more radical restructuring programme to redefine the focus of its asset portfolio”. Despite this, Moody’s cut Anglo American’s rating to Baa3, the lowest investment grade, and placed all ratings on review for a further downgrade, on concerns that a restructuring program would not be sufficient to offset a plunge in commodity prices. Investors also raised concerns for execution risks.

While, Nigerian companies continue to face falling crude prices as oil neared seven-year low this week, it was another poor week for South African stocks. After the JSE weakened following ratings downgrades by both Fitch and S&P for South Africa, broad based losses mostly affected resources names but spilt over to the rest of the market as the week went by. On top of that, the firing of the Fin Min left investors sceptical as they showed their discontentment by punishing the currency down -4.6% to a new all-time low (USD15,43).

Also worth highlighting are the improvements of performance on the DSE ASI (+1.35%), the USE ASI (+2.75%), both coming from negative territories and the ZSE Ind (-0.26%), while the NSE ASI (+1%) pursued its rise this week. On a side note, the BSE DCI, the SEMDEX, TUNINDEX, and LuSE ASI all remained fairly stable.