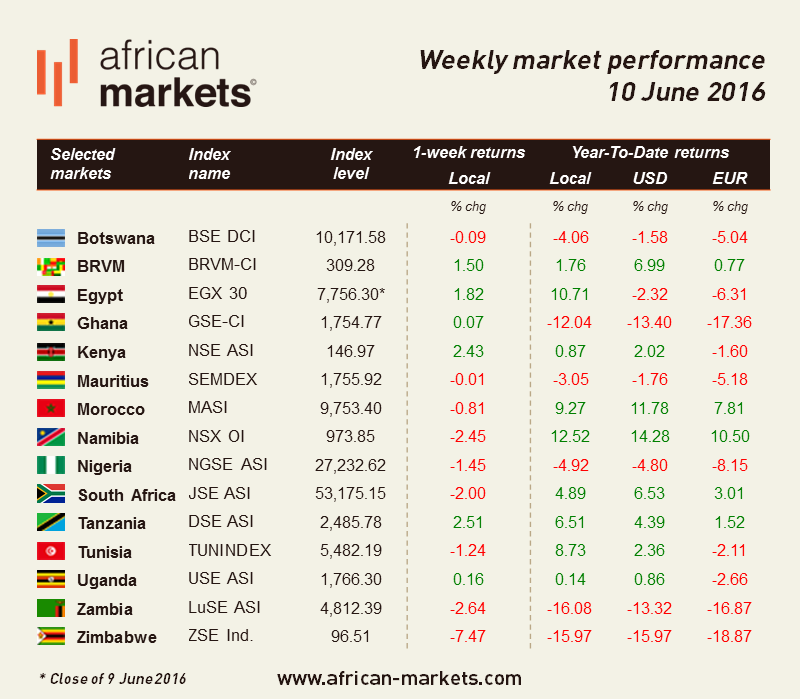

African markets were mostly down this week although for various type of reasons. ZSE Ind. is the worst performer of the week and decreased by 7.47%. The cash shortage has intensified in recent weeks in Zimbabwe so much that a parallel black market has developed. In 2009, Zimbabwe abolished its own currency and replaced it with a multi-currency system after its economy collapsed. In addition to the dollar, the Zimbabwe allows the use of the South African rand, the yuan, the pound and the euro. The dollar currently accounts for about 95 percent of trade. Although that system restrained inflation for a while it also left the government short of cash. There is a situation where people pay a premium for hard cash today. The country’s central bank announced last month it would launch legal tender called “bond notes” pegged to the US dollar. Critics say this plan will worsen the black market as because Zimbabwe is a net importer and bond notes cannot be used to settle invoices abroad and bank cash shortage, importers will be forced to look for the dollar on the black market. This effectively means trading the dollar against itself.

JSE ASI is down 2%. The five-year breakeven rate, a proxy for bond investors’ price expectations, has fallen 39 basis points to 7.06% since the Monetary Policy Committee left its benchmark repurchase rate unchanged at 7% last month. This compares to a 13 basis-point increase in emerging-market peer Mexico and comes as the central bank just stated that inflation will fall back into its 3% to 6% target range in the third quarter of next year. In the meantime, President Zuma and finance Minister Gordhan met with investors to discuss plans to boost output which contracted by an annualised 1.2% in the first quarter. A collapse in commodity prices, a drought, weak export demand and policy uncertainty intensified by news that Finance Minister may be sued and court rulings against President Jacob Zuma have all affected output. Given that inflation expectations are falling and that the MPC has already raised its borrowing cost twice this year, it may slow down on tightening which comes just in time as the country is taking initiatives to stimulate growth. In other news, the MTN saga seems finally over as MTN announced it would pay $1.67 bn over three years to the Nigerian government compared to the $5.2 bn the company was originally fined. MTN shares rose as much as 21% on the JSE following the announcement.

NSE ASI is up 2.43% despite ongoing turmoil in Kenya. Tensions are rising in the country as Kenya’s main opposition country rejected a ban on political protests implemented after at least 5 people died in weekly rallies since April. The opposition wants top electoral officials to resign over alleged corruption and bias toward Kenyatta. Ongoing political uproar threatens to disrupt Kenya’s economy, one of a few in sub-Saharan Africa that is growing as it benefits from low oil prices, a stable exchange rate and slowing inflation.

NGSE ASI decreased by 1.45% as refineries from India to the US are restraining themselves from buying Nigerian oil amid heightened uncertainty about deliveries as the country faces militants in the restive Delta region. Their reluctance to buy is limiting the prices Nigeria can get for its oil despite the fact there is less of it – another hit to the finances of a country facing its worst economic crisis in years. Four of Nigeria's oil grades – including the largest stream, Qua Iboe – have been under force majeure in the past month – a legal clause that allows companies to cancel or delay deliveries due to unforeseen circumstances. The reduced demand means Nigeria is not benefiting as much as others from a rebound in Brent crude prices, which is partly driven by its own oil outages. The Nigerian government set up a team this week to launch dialogue with the Avengers, but the group rejected the offer to talk and blew up another Chevron well.

DSE ASI is up 2.54%. Mucoba Bank has become the first upcountry bank to be listed on the Dar es Salaam Stock Exchange after raising a capital of more than Sh2 billion during its initial public offering.