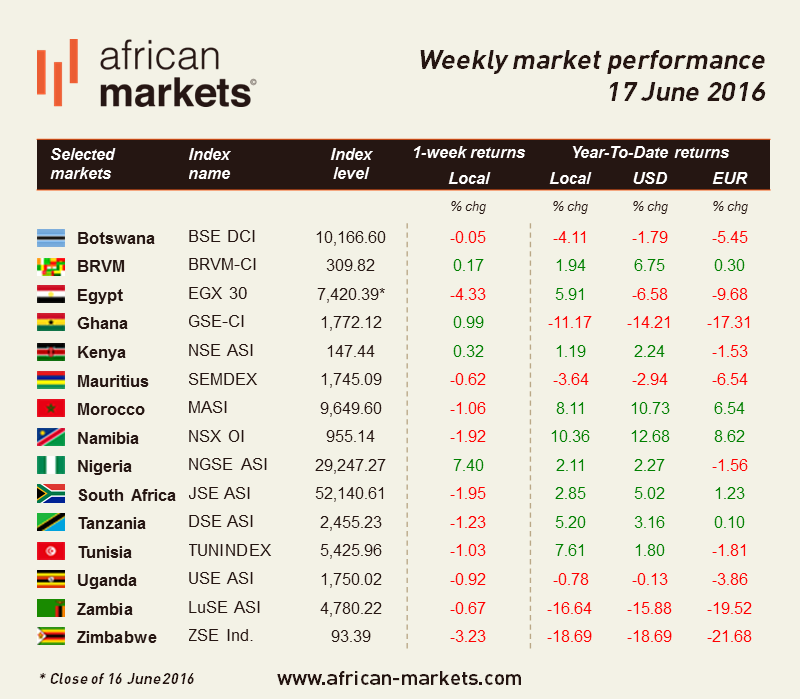

African markets received a welcomed boost in the middle of the week after a cautious Fed policy statement saw investors deferring their expectations regarding the timing of the next hike in US interest rates. The prospect of low borrowing costs in the US boosted the appeal of higher-yielding assets in developing nations however, the sky was somewhat clouded by uncertainty over the UK’s Brexit which has significant echo potential depending on the market.

As a result, JSE ASI like the global market in general was extremely volatile this week. After a general Brexit panic, the rand recuperated some of the losses against the dollar on Friday as risk appetite invigorated after the murder of pro-EU British lawmaker Jo Cox, which markets interpreted as making a Brexit vote in next week's British referendum less likely. Nonetheless, sentiment remained and even the dovish Fed comment was not enough to reassure investors as JSE ASI fell by 1.95%.

GDP contraction and inflation acceleration in May seems to have had the final say in Nigeria. What investors have been begging for too long just happened, the country’s central bank said on Wednesday it will allow the naira to float freely, setting the stage for the currency to weaken. Judging by the effects of the announcement, market enthusiastically welcomed the news as stocks surged with bank shares being the top performers. This unanticipated but well awaited move is a two-edged sword for the country as it may boost inflation which is already very high and force the central bank to raise interest rates, hurting the poorest. In practice, the Central Bank of Nigeria will select a group of around 10 primary dealers through which the naira will be traded. There will only be one official exchange rate with occasional central bank intervention. Three-month non-deliverable naira forwards increased 1.9% to 310 per dollar on the day of the announcement, suggesting traders anticipate the Nigerian currency to trade around that level in the market. Should the new system deliver on its promises, it may prompt the comeback of investors into the market. NGSE ASI climbed 7.4%.

The EGX30 posted a negative performance in the week ended 16 June. EGX30 fell by 4.3% or 335.9 points to reach 7,420.4 points this week; the lowest level in 14 weeks since 11 March, 2016. Selling pressures appeared on Monday because of the failure of completing the acquisition of CI Capital, all stocks involved in the deal, including CIB and Orascom Telecom, were negatively affected.

ZSE Ind. decreased by 3.23% as the economic environment continues to decline in Zimbabwe. The benchmark current level is 59.22% lower than the peak recorded in 2013 towards the end of the government of national unity, which witnessed the economy steadying from the freefall of 2008. The sell-off is comes from an amplified risk in the country where the United States dollar appeal is not there anymore, especially in the current context of monetary challenges.

In Tanzania, the DSE ASI fell by 1.23%. The Dar es Salaam Stock Exchange (DSE) initial public offering (IPO), conducted from Monday 16th May, 2016 to 3rd June, 2016 and aimed to raise TZS 7,500,000,000 from the offer of 15,000,000 shares at a price of TZS 500/= per share, has raised TZS 35,768,796,000, the bourse said this week. This is equivalent to 377% in excess of the targeted capital or 4.77 times the anticipated amount. DSE intends to list its shares on the market’s main segment for trading on July 12.