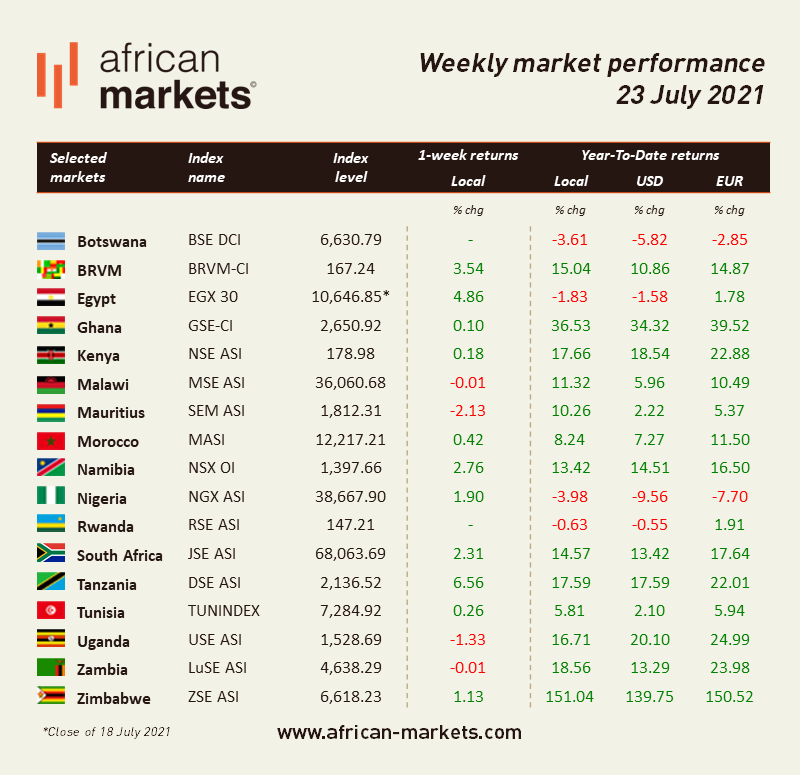

The sentiment was positive on African equity markets this week. Among the 17 markets we cover, twelve advanced while four retreated, and one remained flat. The Dar es Salaam Stock Exchange led the performance charts as Tanzanian equities jumped 6.56%. Conversely, Mauritian equities dropped 2.13%, the most on the continent. Due to the Eid al-Adha celebrations, several markets were closed for one day or more this week.

West Africa

BRVM - Positive sentiment prevailed in Abidjan for the third week in a row. Overall, the Composite Index advanced 3.54% WoW to close at 167.24. Market activity increased 20% as XOF 490m (USD 0.88m) worth of shares changed hands every day on average compared to XOF 407m the week before. The market is now up 15.04% year-to-date, and the total market capitalisation crossed the five trillion XOF mark and reached XOF 5,033bn (USD 9.03bn). SIB (Societe Ivoirienne de Banque) is among the top performers this week. Shares in the financial institution jumped 12% and are up 25.93% YTD. The market heavyweight, Sonatel, closed at XOF 14,275 on Friday (+6.53% WoW). It is now up 5.74% since the start of the year.

NGX - Equities in Lagos rallied this week. The benchmark index of the Nigerian exchange gained 1.90% WoW closing on Friday at 38,667.90. Stocks are now down 3.98% YTD. Activity declined 20% as NGN 1.7bn (USD 4.2m) worth of shares were traded on average over the week. Note it was a short trading week due to the two days public holiday declared by the federal government in commemoration of the Eid el-Kabir celebrations. The total market capitalisation stands at NGN 20.1tn (USD 49.0bn). Total Nigeria Plc is among the top performers this week. Shares in the energy company gained 10% as it declared an interim dividend of NGN 4 per share during the week. The counter is up 56.31% since the start of this year. The market heavyweight, Dangote Cement, soared 7.83% to close at NGN 248 on Friday (+1.27% YTD).

North Africa

BVC - Morrocan equities rallied this week as the MASI advanced 0.42% over the period. As expected, market activity dropped as MAD 28m (USD 3.1m) worth of shares changed hands every day on average compared to MAD 83m the week before. The total market capitalisation stands at MAD 628.3bn (USD 70.02bn), up 8.24% YTD. The Sothema is the second-best performer this week. Shares in the pharmaceutical company gained 7.4% but remained down 38.5% YTD. Earlier this month, the firm announced it would start producing 5 million doses of China’s Sinopharm COVID-19 vaccine. The heavyweight, Maroc Telecom, closed at MAD 134.3 on Friday. The stock is down 7.38% YTD.

EGX - The Egyptian Exchange was closed from Monday 19th of July and Saturday 24th to celebrate Eid al-Adha and Egypt National Day (23rd of July).

East Africa

NSE - Bullish sentiment prevailed in Nairobi this week. The NSE ASI advanced another 0.18% WoW to close at 178.98. The average daily turnover rose 25.5% to KES 459m (USD 4.2m), and the total market capitalisation amounts to KES 2,789.04bn (USD 25.75bn). The market is up 17.66% YTD. Liberty Kenya Holdings is the top performer this week. The shares in the East African insurer soared 27.9% WoW after the news that its South African parent company is the target of a bid by Standard Bank, the South African lender. Shares are now up 24.16% YTD. Safaricom closed at 42.80 KES (up 0.47% WoW). Shares are up 24.96% so far this year.

Southern Africa

JSE - After a sharp sell-off at the start of the week, South African equities rose every day after that, helping the JSE ASI close at 68,063.69, up 2.31% WoW. eMedia Holdings is among the top performers this week. Its shares in the media group jumped 28.31% but remained down 7.67% YTD. The JSE heavyweight, Prosus, closed at ZAR 1,384.94 on Friday (+0.1% WoW). Shares in the tech investor are now down 13.77% YTD.

ZSE - Bullish sentiment prevailed in Harare this week as the ASI advanced another 1.13% WoW. Daily average turnover dropped 23% to around ZWL 118m (USD 1.38m) compared to ZWL 154m the week before. The total market capitalisation amounts to ZWL 779bn (USD 9.10bn), up 151.04% so far this year.