How the Market Reacts to News Is More Important Than the News

They say that the stock market is a great repository of news, rumor, and information. All of it is shared, gawked over, and, finally, interpreted and expressed as sentiment. In the long run, most market reactions to major news events, be they political, economic, or company specific, are forgotten, because all that matters is making money.

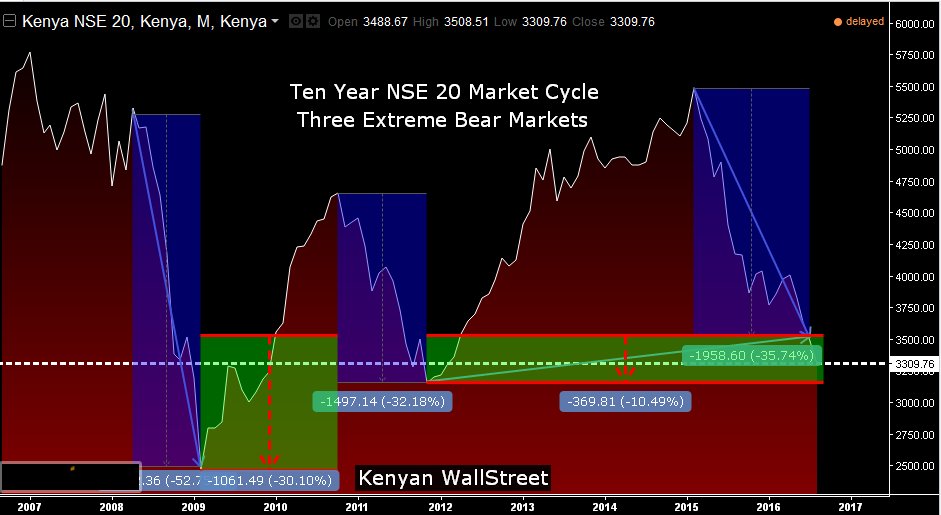

Market Report Thursday 25th August 2016

All Banking Shares on the Nairobi Securities Exchange were clobbered on Thursday a day after the President signed The Bank Amendment Bill 2015 which aims at capping Bank lending rates.

The market lost Ksh 106.01 Billion to end at Ksh 2,003.82Billion. Volumes traded were down by 5.08% to close at 37.62Million from yesterday’s 39.63Million.

All the indices could not hold as the Nairobi All Share fell by 5.01% to close at 139.14. The Benchmark NSE20 plunged 4.41% lower to close at 3309.76 points, this was last spotted in March 2012 as seen in the chart below.

Banks Have Nowhere to Hide

As you can see from the second chart below, Banking sector fell by 7.26% as panic selling began in early trading led by Kenya’s largest bank, KCB Group which shed nearly 10% as investors lost confidence in banking stocks. As at market close, the counter was down 9.9% close at Ksh 29.50 last spotted in December 2012.

Equity Group Holdings was also on a free fall, shedding 9.027% to close at a 16 month low of Ksh 32.75. There was a demand of 16,600 shares against a supply of Ksh 53.025m shares.

Cooperative Bank Kenya took the worst beating since mid 2013, dropping by 9.81% to close at Ksh 11.95. I&M Bank wasn’t spared either, it dropped by 9.8% to close the day at a the most since December 2013 to close at a 32 month low of Ksh 96.50. Barclays Bank was down 8.76% to close at Ksh, 8.85 a new 52 Week low. CFC Stanbic Bank shed 8.125% to close at Ksh 73.50.

Why are things so bad for Kenyan banks?

General fears about fall in profits as the new law aims to cap bank interest rates. Interest income accounts for a significant share (Over 50%) of nearly all the banks profits, and if this is to be regulated, then profits will reduce by a huge margin, a clear indication that Kenyan Banks need to look for other alternatives to generate revenue.

On the other hand, Safaricom continued to lift the entire NSE moving 26.24 Million shares. Market activity was more balanced with foreign participation closing at 51.85%.